TaxTim makes tax returns easy through a virtual assistant called Tim. Many taxpayers don’t feel comfortable doing their taxes by themselves online. In 2016, 5.1m people sought help by visiting SARS branch offices, and another 3.6m people contacted the call centre.

TaxTim's automated online service includes all individuals earning income in South Africa and Namibia, and also South African small and micro businesses. In South Africa, individuals pay between R249 and R499 per year to file taxes via TaxTim, Micro Businesses R1 199, and Small Businesses R1 799. TaxTim is also involved in the training of tax professionals, providing an educational module for tax students at 11 South African universities, as well as a module for article clerks in training.

We did a Q&A with Co-Founder and Director Evan Robinson.

How did TaxTim come about?

In 2011 I had to complete my first tax return and it was much harder than what I anticipated - I really found it painful, unnecessarily complicated and stressful. After struggling with it for a few hours I decided to go and see my friend Marc (Sevitz) who is a tax expert. He was able to simplify the task a great deal by asking me a series of questions one by one. That got me thinking: “Can I put Marc’s brain in a machine and then put it online, so everyone can access affordable tax expertise?”

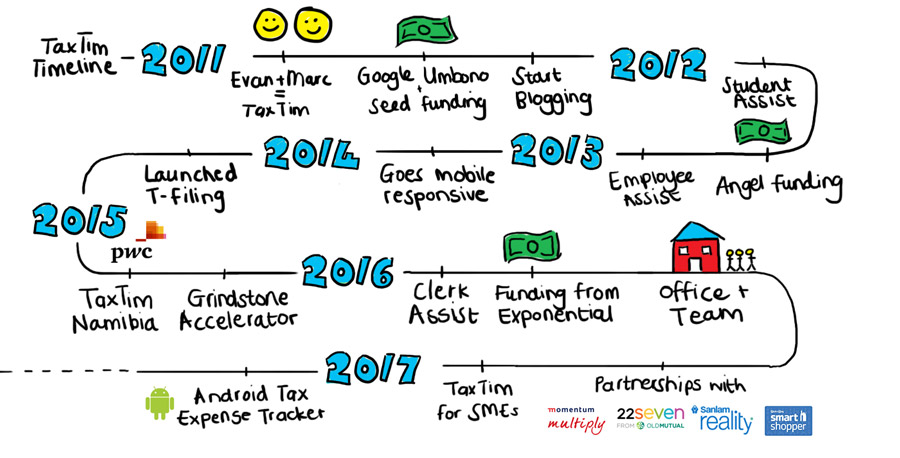

Just a month or so later we heard that Google was setting up an incubator in Cape Town, called Umbono. We decided to apply with our idea of a virtual tax assistant, TaxTim. We were one of the first three teams selected to be part of the program and got seed funding from Google. That was enough for us to build the prototype.

What were the first things you focused on when you started working on TaxTim?

There were two equally important aspects to the prototype: firstly, a scalable, country-agnostic IT platform on which we could build different types of tax return products (my responsibility), and secondly, translating all the most complicated parts of a tax return into simple language that is accessible to ordinary people who are not trained in tax (Marc’s responsibility).

These two things are still definitive for the value that TaxTim creates.

The country-agnostic platform built on AWS enabled us to do the rollout to Namibia in under 3 months. It was literally just a drop and drag exercise to get different tax rules into the system and have it operating there.

Our translation of the tax jargon means that any literate person can understand what they need to do. We put all the information through, what we call, the “idiot filter” - that’s me and the non-tax team. We started out with Marc writing down the questions and answers and then we sat down and argued about the wording of it all until we were both exhausted and red in the face. The pop-up definitions and tax calculators we provide have the same simplicity.

In this way we’ve created a virtual assistant that is easy to use and that people really enjoy interacting with. They find him simple, friendly, and to the point. We really want people to feel that Tim is holding their hand at every step. Having an approachable and helpful character as the face of our business has worked very well for us. And it’s great that we can deploy him to different users and contexts with relative ease.

What aspects of building your business have been very hard?

We realised very early on that tax is not a sexy topic to deal with. That has an impact on how people view our product. You can make a really nice shoe and then show it to people and they will go “Ah, that’s a really nice shoe, I want it.” But no matter how sleek we make TaxTim, tax is not a topic that excites people to take action. Filing taxes is a stressful thing to just think about, let alone get started on. That makes it really challenging to build a marketing campaign around motivating desired actions.

You can’t just say “Use TaxTim! File your tax return now!” People don’t want to do that. They do it when they are emotionally ready.

Right, so how do you work around that?

We’ve learned that we need to engage with people when they’re ready to do so. There is a time, mostly inevitably, when people have to think about taxes. We know we can make the tax submission process a lot smoother for people, so we have to make sure they trust us and remember us when that time comes.

Our challenge is to capture people’s attention whenever they do have an interest in tax - be it a question or a calculation they want to do. From that initial engagement onwards we have different micro conversion activities to acquire users and to ensure they use TaxTim by the time they are ready to file their taxes.

So those are the two hard parts for us: gaining trust in a very small window of opportunity, and converting that trust into a paying customer.

So how do you tackle these challenges? What are you doing to ensure traction?

Our main strategy is to generate leads through our abundant tax content in the off season, and then we work hard to convert those leads when the tax season starts.

The TaxTim blog is the most important aspect of that strategy, and mainly the tax team’s responsibility. We have almost 7 000 articles on the blog and around 160 000 website visitors per month. Blog traffic is also surprisingly constant - we thought it would surge inside of tax season then drop outside of it. People seem to have tax questions throughout the year, and they often confide in us, asking us questions they cannot really ask SARS, like: “What if I just left cash in a briefcase and told nobody?” Our answers are always SARS compliant :) We started out by answering every single incoming question to our helpdesk manually. Now we can serve automated answers to about 80% of all questions asked, but we continue writing about new questions.

Our initial theory was that, if we offer a lot of free tax content via our blog, people would read it, and it would bring them to our website. That has proven to be true, and the blog has been a solid driver of our business growth.

How did you get the word out?

We took the advice from one of our early angel investors to get a proper PR company to drum up publicity. They got us some decent press, and that’s made TaxTim a trusted voice of the people when it comes to South African tax matters. Every year Cape Talk and eNCA call Marc after the budget speech to explain what the implications for ordinary taxpayers are. In 2012 we were on CNBC Africa, Al Jazeera, FinWeek etc.

Do you have any other kinds of channels?

Yes, we also have a variety of partnerships.

With Student Assist and Clerk Assist we get a first move with people who are going to do taxes in future. We’ve trained 10,000+ potential tax practitioners via TaxTim so far.

Then we have partnerships with corporates that have loyalty programmes, like Sanlam, Pick-’n-Pay, Momentum etc. The specifics of these partnerships vary, but it’s a mixture of bulk discounts for members and exposure on our website.

Did you just jump straight into those winning strategies or have you also tried other things?

Not at all. We’ve had some mega fails along the way! For example, we tried a flyer campaign once and sent 5,000 flyers across Cape Town. That failed miserably. We did not have a single tracked conversion from that that we know about. We also created an intricate and amusing blogger campaign where we posted “SARS Survival Kits” to 30 prominent bloggers. I think the result was 2 tweets.

Another idea that didn’t quite have the desired effect is Employee Assist - a discounted offer to employers who want to offer TaxTim as a perk to their staff. We thought that employers would be keen to help their employees be tax compliant, but that’s just not the case. Most employers just don’t want to get involved, except for a few smaller companies where retaining staff matters and providing the benefit makes sense. It’s interesting though that it has been a lot more successful in Namibia where PWC acts as our partner and has strong corporate relationships. In general we’ve found that partnering with corporates in the financial space helps with customer adoption - they’re receptive to new financial tools when presented alongside a brand they recognise already.

How do you think about scaling TaxTim? Do you focus on expanding your offering or improving the existing product?

We think about scaling in three categories: create scale, handle scale, and retain scale.

Creating scale is about all the things that gets us customers - bringing people into the funnel. Handling scale is about supporting customers throughout their tax-filing journey in the fastest way possible. And retaining scale is about doing things that delight people and get them to come back.

Our goal is always to improve our individual products.

We identify the bottlenecks in the product by tracking where people fall off in the process of completing their return, where they seem to get confused, or where they’re simply taking too long. Then we zoom in on the problem areas, and make changes. We launch an updated return system every year, but multiple smaller upgrades every day.

We also continuously add new features. T-filing, our integration with SARS’s e-filing, is the best example of that. E-filing is technically SARS’s DIY tax return tool, and it has a list of features. Only now can we say that we match all those features, and then go the extra mile too with our own functionality. Instead of emailing you to say that a letter is waiting on eFiling for you, we will actually fetch the letter for you, read the PDF, and translate the body of it into something you can understand - then email you. Essentially we’re an easier interface for the SARS eFiling system.

Another example is the Tax Expense Tracker launched in March this year. It’s an android app that you can use to keep track of expenses by taking photos of slips and documents throughout the year. It keeps all your numbers together so they’re ready by the time you need it for filling into your return.

What are you and your team focusing on right now?

We are focusing on the launch of our Small Business tax return product, the upcoming individual tax tax season in July and a large content reshuffle. We are also exploring creating a new product specifically for payroll companies.

What is the next big thing that you want to tackle?

TaxTim has access to extraordinary detail about your financial situation, after having entered in this information for your tax return. We are well placed to make use of machine learning and big data analysis to help people - particularly South Africans who are not financially savvy - with diagnosing problems in their financial lives and pointing them toward solutions that might help them going forward.

We would also like to expand TaxTim into more countries in Africa and the developing world, where alternatives simply do not exist. We are looking at our partner strategy to find the ideal partner that has global reach with the right consumer-focused target market for our product. We have also been in touch with the revenue services directly.